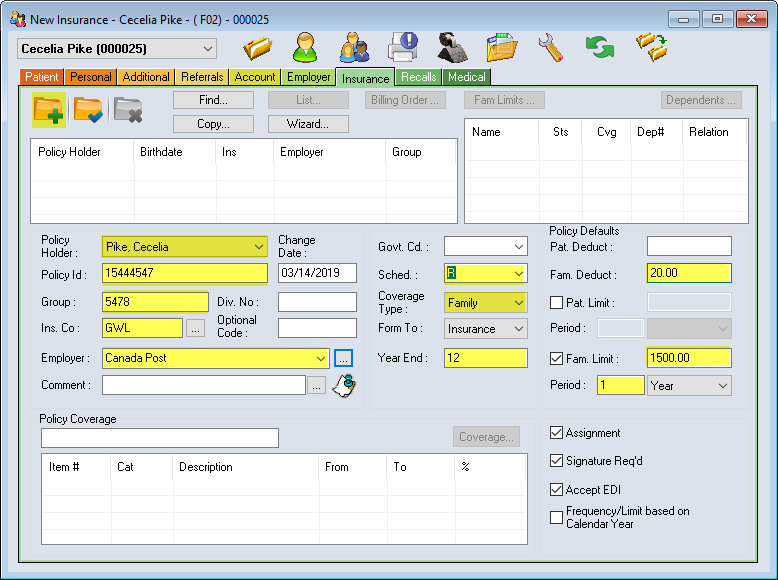

If you cannot find the group number in the system, you will have to create the policy manually. The information required to create the Unique Policy must be provided by the patient. The Unique Policy (Employer, Insurance Company and Group Number) fields are required in order to save the entry.

Add a New Policy

- Click the Create Record icon

- Check the Policy Holder field for the correct name.

- Enter Policy Id.

NOTE: This number is unique to the Policy Holder. It is the number that the insurance company uses to identify its members e.g. employee number. - Enter Group Number (and Div No. if available).

- Enter Ins. Co. (Insurance Company) code.

NOTE: Every Insurance Company has been assigned a code that can be searched for in the ellipses button. Enter the first letter of the insurance name and use the magnifying glass

button. Enter the first letter of the insurance name and use the magnifying glass  to search.

to search. - Enter Optional Code if desired.

NOTE: This field can be used to enter additional policy identifiers that may help to differentiate unique policies that share a common group number. Consider this a free note/identifier space, specific to your clinic. - Enter Employer name.

NOTE: An existing employers list is found in the ellipses button. If a different spelling is used for the same employer, an additional employer will be created. If the employer name is unknown, then the Insurance company + group number can be used temporarily. Avoid duplicating employers as it makes cleaning up Insurance information quite difficult.

button. If a different spelling is used for the same employer, an additional employer will be created. If the employer name is unknown, then the Insurance company + group number can be used temporarily. Avoid duplicating employers as it makes cleaning up Insurance information quite difficult. - Leave the Govt. Cd. field blank. This box should be empty as it is no longer used by insurance companies. Use the Schedule instead to specify the plan fees.

- Enter the Fee Schedule the insurance company pays under from the drop-down menu. Default is set to R (Regular Current Schedule).

- Confirm Coverage Type, Family(default) or Patient based on their plan coverage.

- Enter the Year End Month of the plan (Default is 12-December).

- Enter Pat/Fam Deductible if applicable.

NOTE: Patient Deductible is the $ amount that is deducted from each patient in the family upon submitting their first claim of the year. However, if there is a Family Deductible, it is the maximum $ deducted regardless of the number of family members. - Enter Pat/Fam Limit if applicable.

NOTE: These limits refer to a combined maximum allowable regardless of the type of treatment. The roll over period can be set in months, years or lifetime.

Confirm Assignment, Signature Required, and Accept EDI. These are defaulted by the Insurance Company selected. - Click Save.

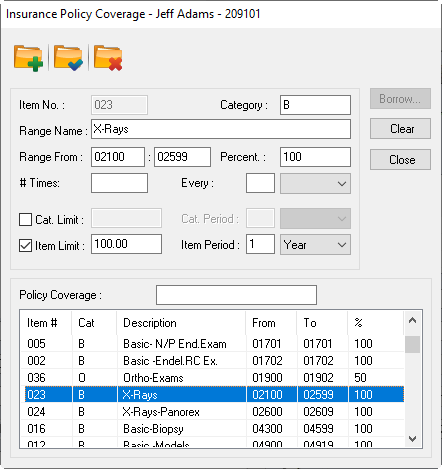

- The Policy Coverage box opens. Click Borrow.

- Click on the drop-down arrow and select the closest template to the policy coverage, click OK.

- Adjust the Template according to the parameters of the policy.

Percent: Adjustments can be made for a single range line (Item#) or for the Category (B, M, O). Highlight the Item # line, go to the Percent: field, highlight and enter the new percentage.

Frequency Limit: Some insurance policies limit the number of times a procedure(s) are allowed over a time period.

Edit the # Times field and adjust the time period (Every: field).

Cat. Limit (Category): This is the amount available for all items within a specific Category (eg. Major Category includes all Crown & Bridge procedure codes for a maximum of $1500.00). Any unused balance cannot be transferred to another category.

Item Limit: This is the amount available for the specific item line chosen. Only the treatments covered by this item line range will adhere to this limit In the example shown above, the X-Ray item has a specific limit of $100 annually. This means all codes between 02100-02599 will use up this specific limit when billed. - Select Close once all necessary adjustments are made.

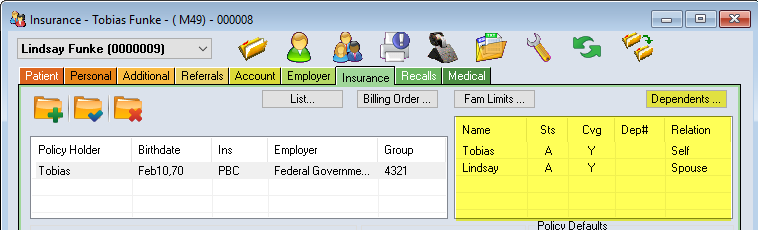

- The final step is to check the Dependents box for accuracy (upper right corner).

- Begin by highlighting the policy holder’s name and click on the Dependent box.

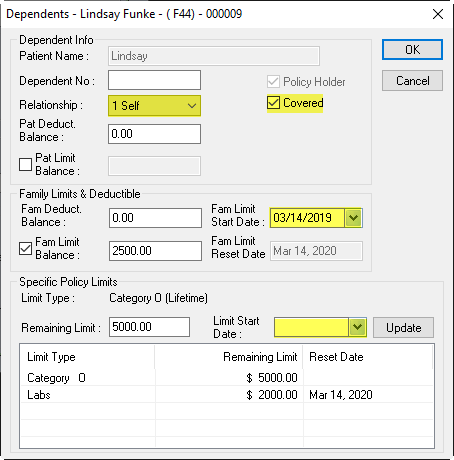

- Add or confirm Dependent Relationship, and whether the Patient is Covered.

- Limit Start Date fields (highlighted below) should be cleared unless the policy rollover is longer than 12 months/1 year.

NOTE: Deductibles and/or Limits may need adjusting if the patient has made previous claims on their policy this billing year.

- Click OK.

- Review the policy one last time and Save your work.